Social Security Alerts, News & Updates

Social Security at 62: A Strategic Wealth-Building Move

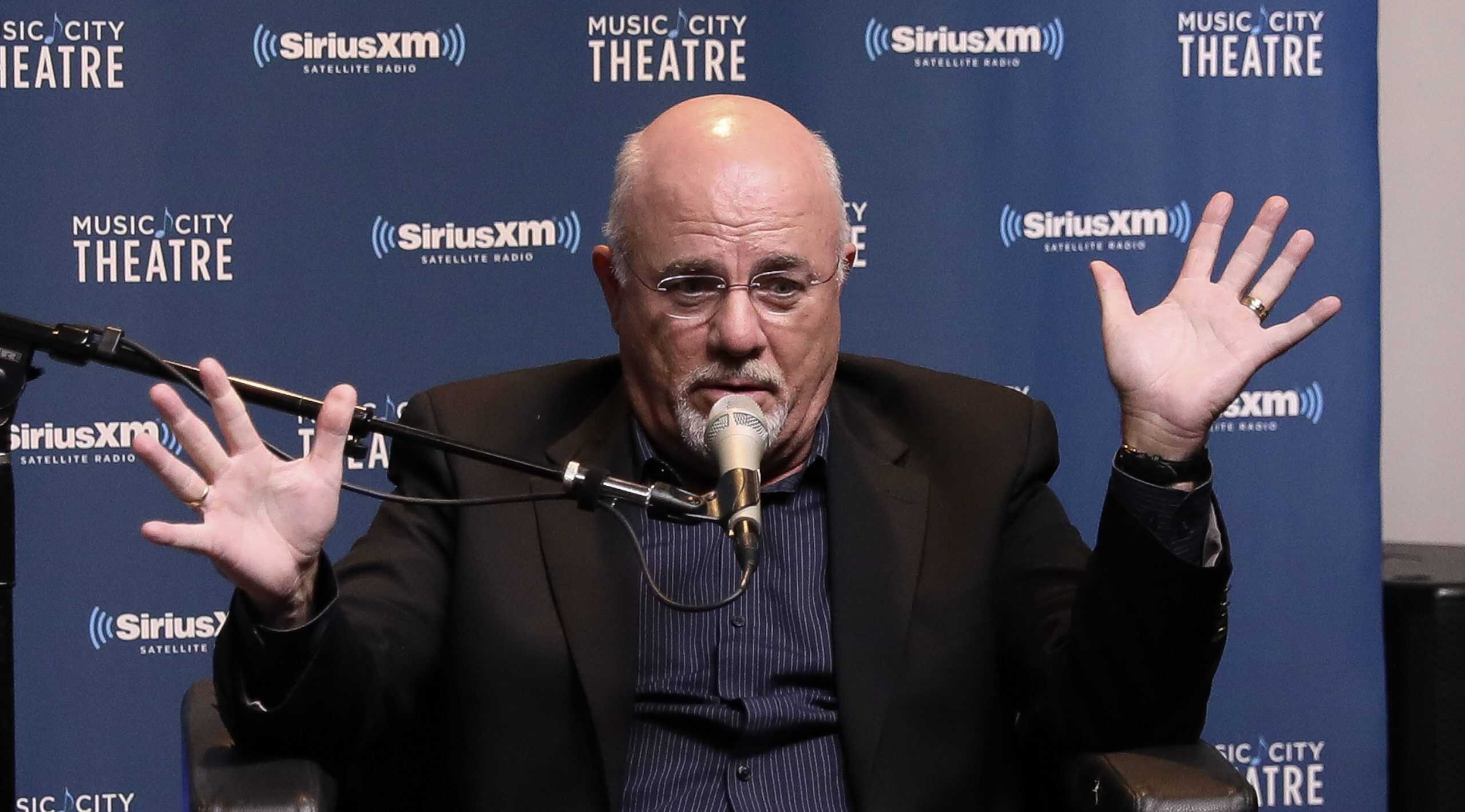

Dave Ramsey’s Social Security Strategy: Why Taking Benefits at 62 Might Be Smarter Than You Think

Let’s be honest: financial advice isn’t one-size-fits-all. While I don’t always agree with everything Dave Ramsey’s Social Security Strategy says, there’s one Social Security recommendation that caught my attention – taking benefits at 62. Before you dismiss this idea, hear me out.

Why Early Social Security Might Make Financial Sense

Imagine having extra cash in your early 60s when you’re still energetic and ready to enjoy life. While delaying Social Security benefits means a larger monthly check later, the value of money today might be more significant than you realize.

Key Reasons to Consider Early Social Security Benefits

Here are three compelling reasons to think about claiming Social Security at 62:

- Health Uncertainty: Life is unpredictable. If you’re in good health now, why wait?

- Investment Opportunities: You could potentially invest your SSA benefits and grow your nest egg faster.

- Financial Flexibility: Having extra retirement benefits provides options and peace of mind.

The Strategic Investment Approach

Even if you don’t immediately need the money, taking Social Security at 62 opens up interesting investment possibilities. Ramsey suggests investing these funds in:

- Solid mutual funds

- Low-cost index funds

- Diversified retirement investment strategies

By doing this, you might actually come out ahead compared to waiting until 70. For more insights, check out our article on The Strategic Investment Approach.

Breaking Down Social Security Benefit Numbers

| Claiming Age | Monthly Benefit | Key Considerations |

|---|---|---|

| 62 | 70% of Full Retirement Age (FRA) benefit | – Early access to funds – Potential for investment growth |

| Full Retirement Age | 100% of benefit | – No reduction in monthly amount – Standard retirement timeline |

| 70 | 124% of benefit | – Maximum monthly payment – Ideal for those with longer life expectancy |

For a comprehensive guide to understanding Social Security benefits, visit Breaking Down Social Security Benefit Numbers.

Personal Circumstances Drive Social Security Decisions

Remember, there’s no universal “right” answer. Your health, financial situation, and personal goals will ultimately drive this decision. A qualified financial advisor can help you navigate these nuanced Social Security choices.

The Bottom Line on Social Security Planning

Dave Ramsey’s advice to consider Social Security at 62 isn’t about being rebellious—it’s about understanding your unique financial landscape. If you value flexibility, potential investment opportunities, and want to enjoy your money while you’re still young and active, this strategy might be worth exploring.

Just don’t take my word—or Ramsey’s—as gospel. Do your homework, crunch the numbers, and make the choice that feels right for you.